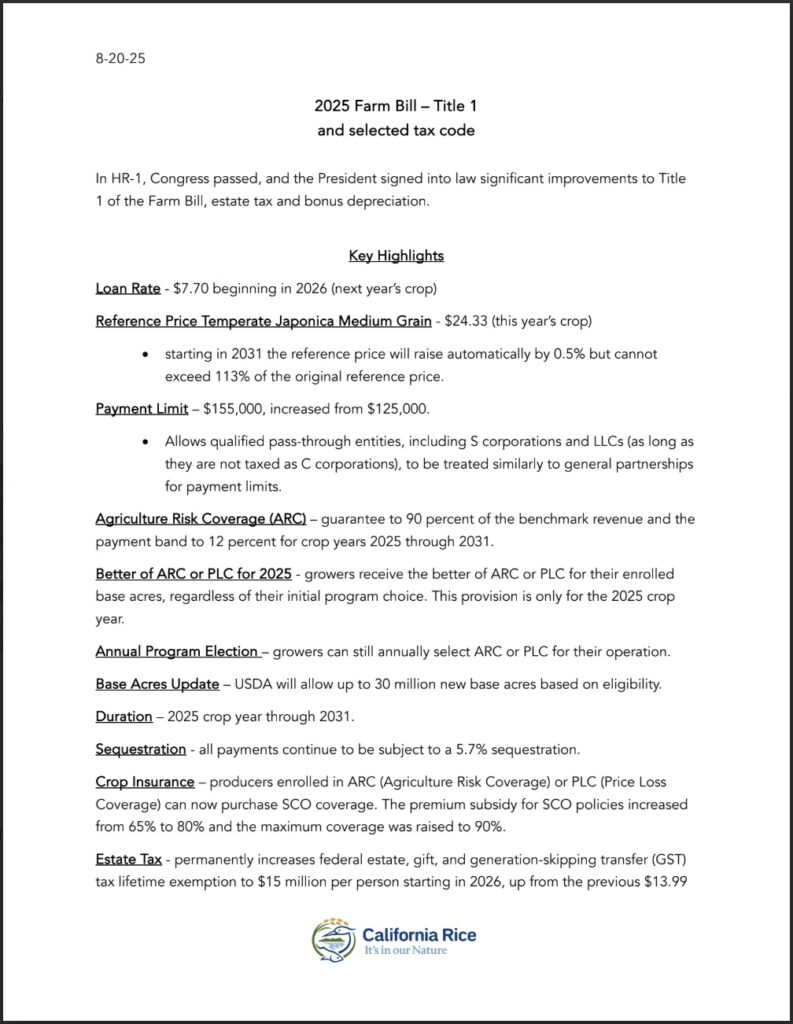

In Congress’s budget reconciliation, signed on July 4 by President Trump, significant improvements were made to Title 1 of the Farm Bill, including:

- Loan Rate – $7.70

- Temperate Japonica Medium Grain Reference Price – $24.33

- $155,000 Payment Limitation, increased from $125,000

- These changes will be for the 2025 crop year through 2031

- Starting in 2031, the reference price will rise automatically by 0.5% but cannot exceed 113% of the original reference price

- Agriculture Risk Coverage (ARC) guarantees 90 percent of the benchmark revenue and the payment band of 12 percent for crop years 2025 through 2031.

Notes to remember:

Growers can annually select ARC or PLC for their operation. All payments continue to be subject to a 5.7% sequestration.

USA Rice

The US rice industry was only able to achieve these results through collaborative work among all states. Great credit is due to USA Rice for their years-long work on improving the rice safety net and support of both Chairman GT Thompson and Senate Ag Committee Chair John Boozman.

Please find their comprehensive analysis here.

Next

The conservation title and other titles of the farm bill will be taken up by the House and Senate Ag committees in a skinny farm bill this fall. Bi-partisan work is expected.

By Tyson Redpath, The Russell Group

This January, a new Republican majority arrives to the U.S. House of Representatives holding a four-vote majority which is identical to the current House Democratic majority. A flip to GOP control will have only modest policy impacts because the Senate majority will stay in Democratic hands. Meanwhile, the Biden Administration will continue to chart a course for rulemaking and Executive Order action for at least the next two years.

READ MORE

By Tyson Redpath, The Russell Group

In the midst of a pandemic, the USDA is continuing to remind producers that 2020 enrollment for the ARC and PLC farm bill safety net programs is open now. Growers must enroll for 2020 by June 30. Growers are also reminded that they must make their one-time update to PLC payment yields by September 30.

READ MORE